Introduction

While the global machine tool manufacturing industry is lamenting the precision of German machine tools and the efficiency of Japanese machine tools, the American machine tool industry is like a sharp sword hidden deep in its sheath. Behind Haas, which ranks ninth in machine tool sales, is the absolute dominance of the United States at the top of the industrial pyramid – the latest data shows that the average unit price of American ultra-precision machine tools is as high as 1.5 million US dollars, which is twice that of Germany (800,000) and 5 times that of Japan (300,000).

Comparison of Machine Tool Strength among the United States, Japan, and Germany

| Dimensions | USA | Germany | Japan |

| Technological High Ground | The ultimate machining accuracy is 0.5 microns. | Stable accuracy 1-2 microns | Batch accuracy 5 microns |

| Average price per unit | $1.5 million | $800,000 | $300,000 |

| Proportion of top companies | Global ultra-precision machine tool market share is 61% | High-precision machine tools market share 29% | Market share of mass-produced machine tools: 53% |

| Military industry dependence | Defense orders account for 38% of production capacity | Military industry accounts for 12% | Military industry accounts for less than 5% |

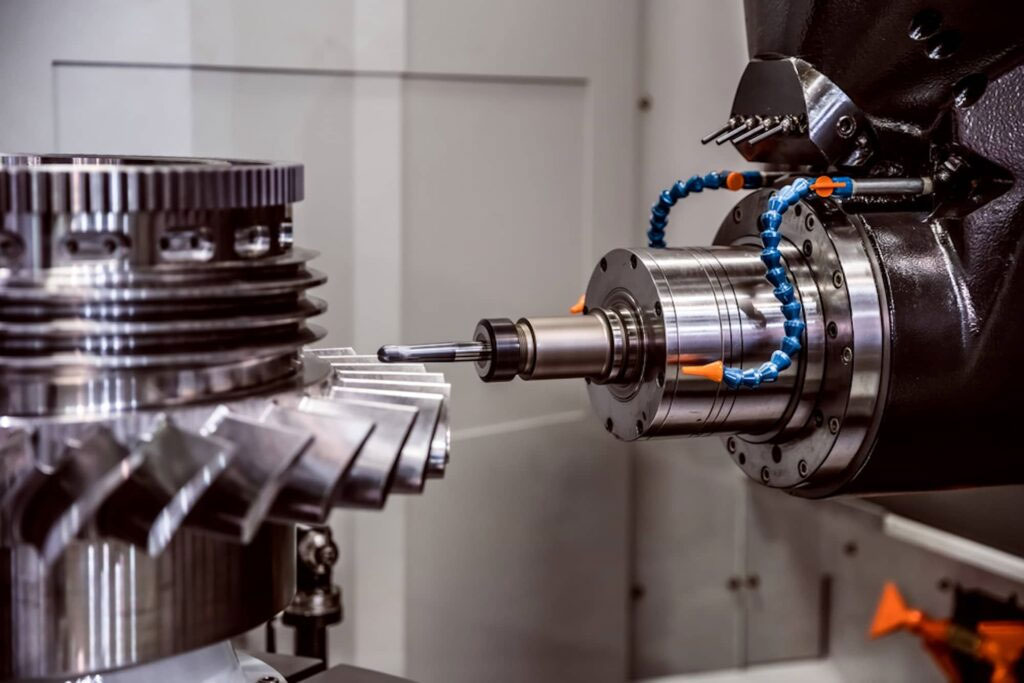

The United States: Building heavy equipment that others cannot

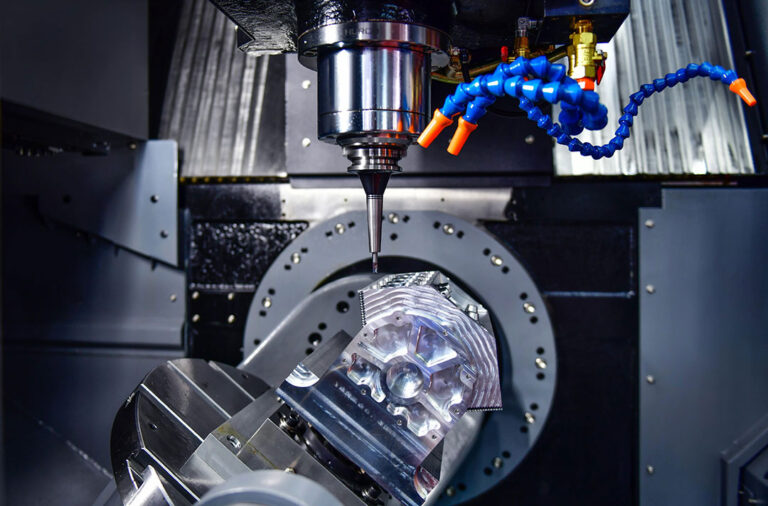

“Space-grade machining” monopoly : NASA’s InSight Mars rover titanium alloy wheels are carved by Haas five-axis machine tools with an error of less than 0.001mm – equivalent to 1/80 of a hair.

Giant equipment: The 2,500-ton gantry milling machine built by Ingersoll for the Chilean giant telescope can process 18-meter brackets with a flatness error of less than 0.05mm. This technological monopoly has not been broken so far.

Algorithm moat: Gleason machine tool’s gear meshing algorithm is listed as a “national critical asset” by the Pentagon, and 95% of the world’s high-end helicopter transmission systems rely on it for processing

Military technology transfer: The U.S. Department of Defense invests $2.6 billion annually in machine tool research and development, resulting in super-hard coating technology such as Morley cutting tools, which can increase tool life by 30 times. However, due to the high cost ($8,000 per tool), it is only used by the military industry.

Germany: A paranoid pursuit of precision

TRUMPF laser cutting machine can make 0.01mm micro-holes on heart stents, with a precision exceeding that of surgical scalpels.

Process database: DMG Mori Seiki has accumulated 1.5 million material processing parameters, with 42,000 hardened steel milling solutions alone.

Germany has 73 “hidden champions” in precision parts, such as ball guide giant Rexroth, which accounts for 47% of the global high-end market.

The 2023 Hannover Industrial Fair revealed that 35% of Germany’s high-end machine tool core electric spindles rely on Japan’s Mitsubishi Electric.

Japan: The King of Mass Production Scale Effect

Mazak’s IoT factory rolls off a machine tool every 47 seconds, with more than 60,000 devices connected worldwide.

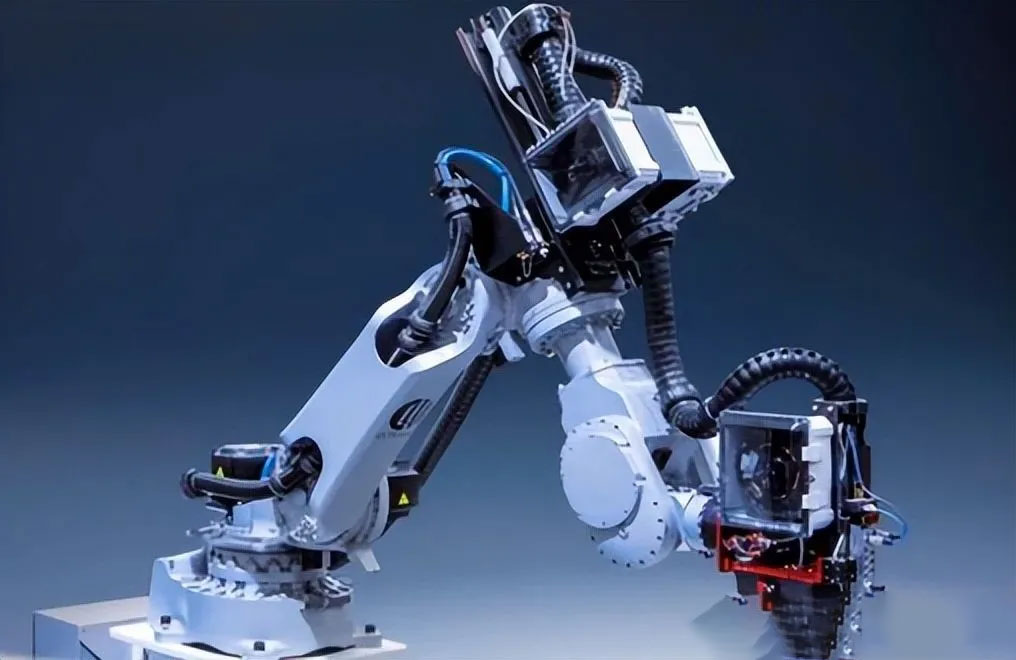

FANUC Robotics Dominance: 1 in 2 industrial robots in the world uses its servo system.

Japan has reduced the production cost of lead screws to one-third of that of Germany through component standardization, and the price of linear motors is only one-fifth of that of the United States.

Bottleneck emerges: Japan’s Ministry of Economy, Trade and Industry report admits that it lags behind the United States by 15 years in the field of ultra-precision optical processing, and EUV lithography mirror processing equipment is 100% dependent on imports.

The decisive point in the next decade

United States : The Department of Defense’s “Ultra-Precision 2030 Program” has invested $11 billion, focusing on breakthroughs in atomic-level processing (precision 0.1 nanometers).

Germany: Fraunhofer Institute leads process-data fusion, aims to increase overall equipment effectiveness (OEE) to 98%.

Japan: The Ministry of Economy, Trade and Industry and Toyota jointly developed the “Dark Factory 2.0”, aiming to reduce unmanned production costs by another 40%.

When the lifeline of high-end manufacturing is strangled

Chinese semiconductor companies purchasing Swiss Starrag five-axis machine tools must be reviewed by the US Department of Defense.

The European Airbus A350 wing beam processing must use the American Hurco WinMax control system.

Mitsubishi Heavy Industries’ ship-use gas turbine blades still need to rent American Ingersoll equipment for processing.

The essence of global machine tool competition is a clash of industrial philosophies: Japan conquers the market with efficiency, Germany defines standards with precision, and the United States -only solves “impossible tasks.”

While the world is fighting for scale and precision, the United States quietly controls the lifeline of high-end industrial manufacturing. The future of high-end manufacturing is destined to be a survival game for a small number of players.