Introduction

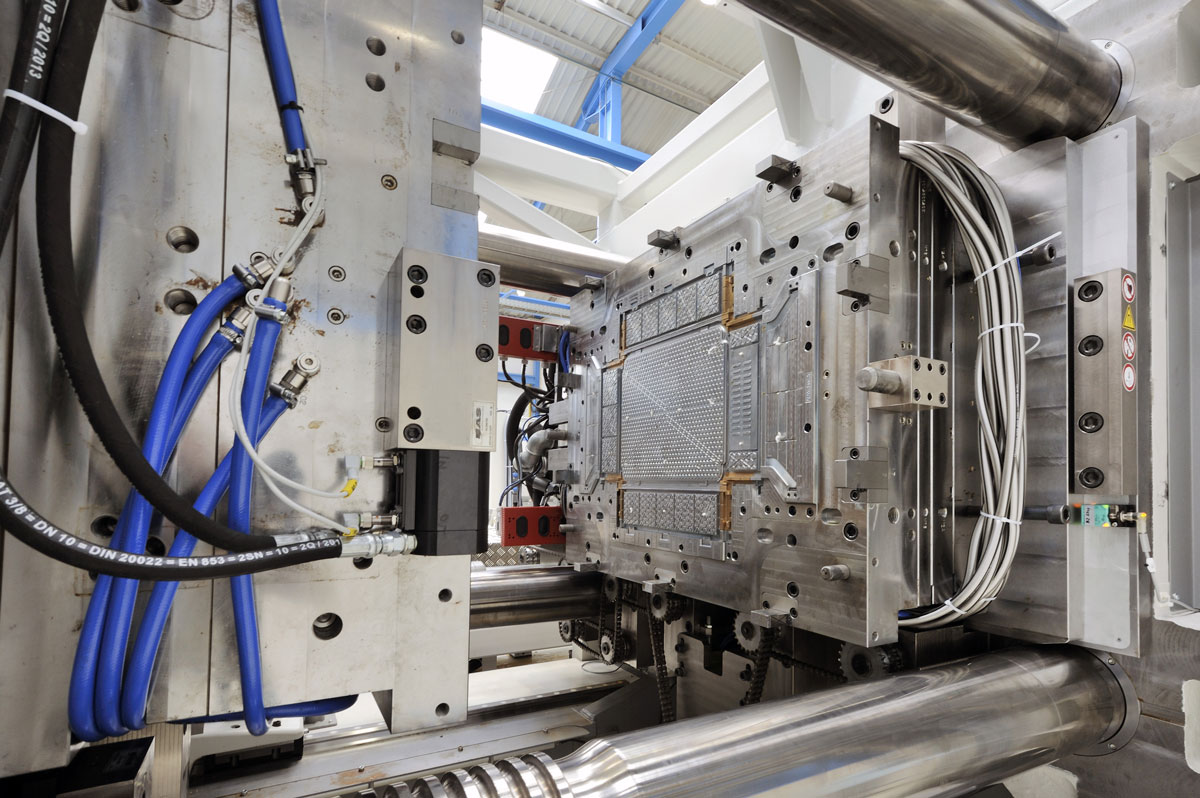

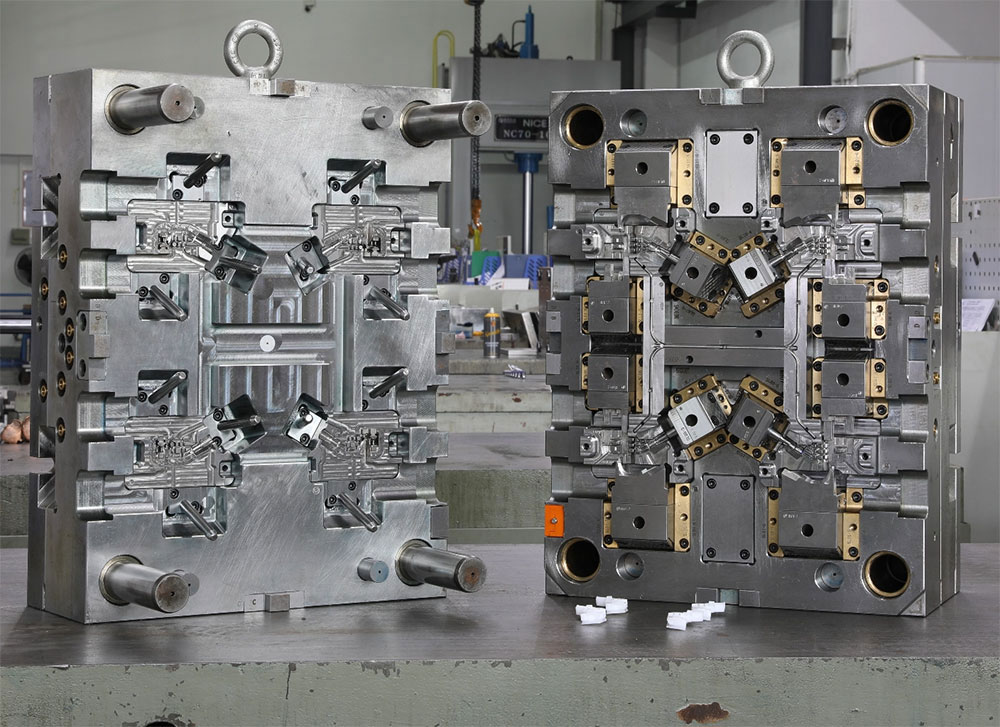

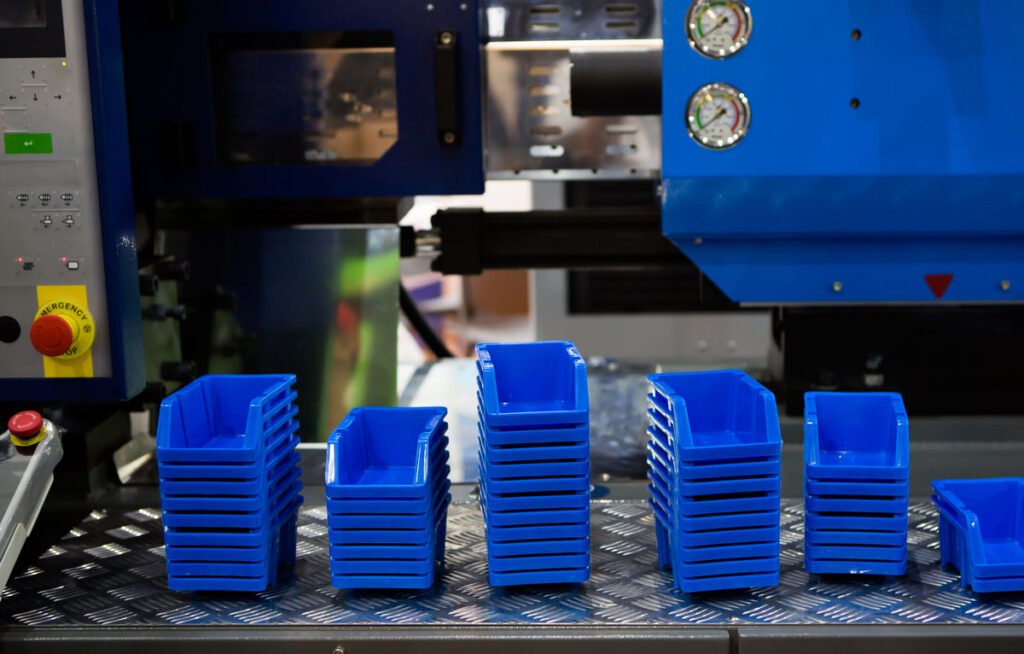

Injection molds are called the “mother of industry”. The products they produce can be used in all walks of life and can be said to be indispensable industrial products.

The domestic injection mold industry has been developing for decades. Although it has reached its historical peak, it is also facing six major difficulties. If these six difficulties cannot be overcome, the entire industry may stagnate or even gradually decline.

So, do you know what the six major difficulties of injection molds are? Let’s get straight to the point!

Six major difficulties facing the injection mold industry

1. the intensified market competition and compressed profits

The intensified market competition and profit compression in the injection mold industry are the core challenges currently facing the industry. The causes involve the combined effects of multiple factors such as supply and demand imbalance, rising costs, and weak technical barriers.

- Overcapacity triggers a vicious cycle of price wars

In the domestic market, the low-price competition in the injection mold industry has reached a white-hot stage. One of the reasons is the overcapacity in the injection mold industry, especially in the two core industrial belts of the Pearl River Delta (Dongguan, Shenzhen) and the Yangtze River Delta (Ningbo, Taizhou), where the overcapacity is more obvious.

There are more than 8,000 mold companies in the Pearl River Delta alone, of which 60% are small and micro enterprises with an annual output value of less than 20 million yuan, and the capacity utilization rate of homogeneous injection molds is only 65%. The overcapacity rate of home appliance/daily chemical molds in the Yangtze River Delta is 40%.

The second reason is that the OEMs are suppressing prices. The OEMs use the “N+3” price comparison model (1 existing supplier + 3 new quotations) to force price cuts.

The average annual decline in mold purchase prices is 5%-8%. In order to pass on the pressure, first-tier suppliers require mold prices to be reduced by 10%-15%, forcing small and medium-sized mold manufacturers to follow suit in order to secure orders.

This creates a vicious cycle: low-price competition → insufficient profits → inability to invest in R&D (industry R&D investment accounts for only 1.2%) → technological stagnation → deeper price wars.

- International competition is a double-edged attack

In the international market, German and Japanese companies monopolize the high-end mold market (the market share of automotive precision molds exceeds 60%), and domestic mold companies find it difficult to compete with them. In the mid- and low-end markets, Southeast Asian countries have a labor cost advantage (the salary of Vietnamese mold engineers is about 1/3 of that in China), further squeezing the survival space of domestic manufacturers in the international market, making it more difficult for domestic molds to enter the international market.

2. the bottleneck of technology upgrading

The bottleneck of technology upgrade in the injection mold industry is the core obstacle that restricts the industry’s transformation to high-end. Its complexity is reflected in the intertwined shortcomings in multiple dimensions such as equipment, materials, processes, and intelligence. The following are the main reasons.

- Insufficient precision manufacturing capabilities

Due to factors such as the serious gap in core equipment for injection mold processing, the insufficient precision of domestic equipment, and weak digital design capabilities, the domestic injection mold industry’s precision manufacturing capabilities are insufficient, hindering technological upgrading.

- Lagging behind in the application of new materials

Domestic injection mold high-end materials rely on imports, while domestic mold steel has low purity and special steel research and development lags behind. In addition, additive manufacturing technologies such as conformal waterway technology and composite molds have also encountered bottlenecks and their application has lagged behind.

- Dilemma of intelligent transformation

Due to the gap in intelligent equipment and limited application of robots, the hardware penetration rate is low. Problems such as data silos and lack of knowledge management have caused the fragmentation of the software system, making the intelligent transformation difficult.

- Weak accumulation of process technology

Other domestic industries are heavily dependent on reverse engineering and lack innovation. Compared with foreign countries, micro-molding technology has obvious shortcomings and weak accumulation of process technology, which has hindered technological progress.

- Insufficient interdisciplinary collaboration

For example, material-mold coordination failure and product-mold disconnection also hinder the technological progress of the injection mold industry.

- Talent structure gap

Young people are reluctant to enter the injection mold industry, and the lack of a training system has led to a skills gap crisis and lagging knowledge updating.

3. the deterioration of cost structure

The deterioration of the cost structure of the injection mold industry is one of the core issues currently restricting the development of enterprises. Its causes involve multiple pressures such as raw materials, manpower, energy, and environmental protection, and are closely related to the game between upstream and downstream of the industrial chain.

- Uncontrolled increase in raw material costs

Due to the rising prices of mold steel and inflation of auxiliary materials, the cost of mold raw materials has soared.

- Energy and equipment costs surge

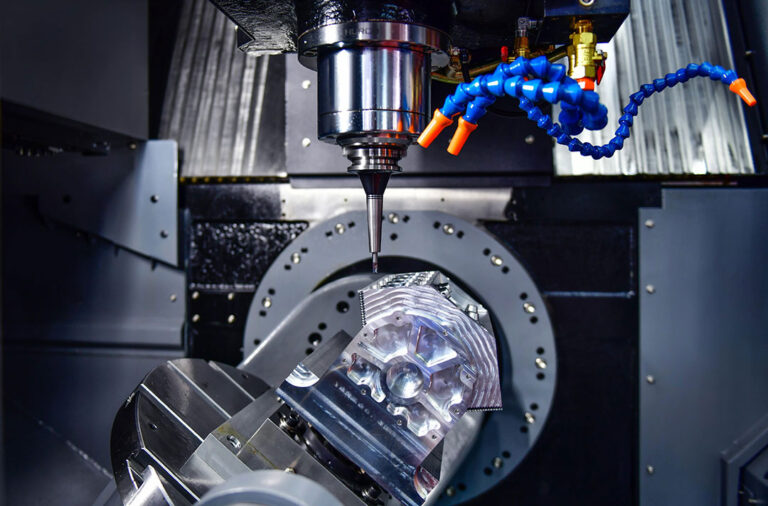

For example, the increase in industrial electricity prices has increased the proportion of EDM costs from 8% to 15%. The increase in cutting fluid has led to a 40% increase in machining fluid consumption costs. The 30% increase in CNC equipment prices has led to an increase in equipment depreciation from 12% to 18%.

- Structural contradictions in labor costs

Skill premium and loss coexist. Salaries of senior mold designers have risen sharply, but the talent gap is still large. Compliance costs are rising, increasing the cost burden of enterprises.

- Industrial chain transmission effect

The cost shifting by OEMs and the worsening payment cycle have caused the mold industry to bear more industry chain costs.

- The cost of technology substitution is surging

The rising cost of intelligent transformation and the out-of-control cost of trial and error have led to a surge in the cost of technology replacement.

- Costs of international trade friction

Tariff barriers and certification barriers increase the friction costs of international trade.

4. The dilemma of industrial chain coordination

The dilemma of industrial chain coordination in the injection mold industry stems from the interweaving of multiple factors such as imbalance in supply and demand structure, contradictions in interest distribution and fragmentation of technical standards. The specific reasons are as follows.

- The contradiction between demand-side fragmentation and supply chain rigidity.

Order miniaturization trend: The order volume of new energy vehicle molds has dropped by 60%, and the life cycle of a single product has been compressed from 5 years to 2-3 years;

Small batch orders (less than 10 sets) account for 45%, but the production lines of mold companies are still designed for a scale of more than 50 sets.

Inaccurate demand forecasting: The product iteration cycle of OEMs is shortened to 8 months, and mold companies need to prepare materials 6 months in advance; the mold modification cost caused by demand changes accounts for 32% of the total cost, up from 18%.

- The deterioration of capital flow has triggered a crisis of confidence.

The payment period was extended from 60 days to 180 days. The mold factory had tight cash flow and refused to accept long-term orders. The warranty deposit ratio was increased from 5% to 20%, which occupied the company’s working capital and inhibited technology investment.

The OEM unilaterally defined the mold defect standards, dispute resolution took more than 6 months, and the willingness to cooperate decreased.

- Technical standards fragmentation and data silos

Inconsistent design standards: German/Japanese/domestic OEMs have 40 different mold acceptance standards (such as parting surface tolerance ±0.02mm vs ±0.05mm); 70% of mold factories need to maintain more than 3 sets of design specifications at the same time, increasing labor costs by 20%.

Data circulation barriers: OEMs use NX, while mold manufacturers mostly use UG, with data conversion accuracy loss reaching 0.01mm; the matching rate between CAE simulation data and processing equipment parameters is less than 50%, resulting in a 3-fold increase in the number of mold trials.

- Distorted benefit distribution mechanism

Price transmission imbalance: OEMs require 8-12% price reduction each year, but the cost of raw materials such as mold steel increases by 15%; profit distribution ratio: OEM 52% → Tier 1 supplier 30% → mold factory 18%.

Risk transfer intensifies: OEMs transfer 90% of inventory pressure to mold factories (the penetration rate of the VMI model reaches 60%); mold factories bear 80% of the risks of new material development (for example, the trial production failure rate of carbon fiber reinforced plastic molds exceeds 70%).

- Capability mismatch and delayed response

Technology response gap: The proportion of mold factories involved in the product design stage is less than 20%, resulting in a 5-fold increase in the cost of later modifications; The mold development cycle for new processes such as liquid silicone rubber (LSR) is 40% longer than that of Japanese companies.

Rigid capacity allocation: emergency orders from OEMs account for 35%, but equipment switching at mold factories takes more than 48 hours; due to intellectual property disputes, the equipment sharing rate of shared manufacturing platforms is less than 25%.

- Lack of ecosystem collaboration mechanism

The disconnect between industry, academia and research: the conversion rate of mold research results in colleges and universities is less than 10%, and the matching degree of enterprise needs is less than 30%; the number of joint laboratories only accounts for 5% of the industry’s technology investment projects.

Failure of industry platforms: The proportion of transactions on the Internet platform of the mold industry is less than 3% (due to data security concerns); among the 112 standards formulated by the regional mold alliance, the actual implementation rate is only 38%.

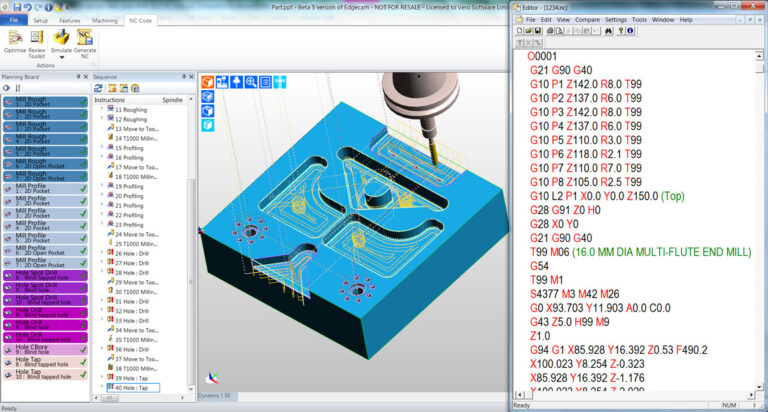

5. The challenge of digital transformation

The digital transformation challenge of the injection mold industry is the core problem that currently restricts the upgrading of the industry. Its complexity is reflected in the systematic obstacles in multiple dimensions such as technology, management, and ecology. The main reasons are as follows.

- Insufficient penetration of smart equipment

Weak hardware foundation: The penetration rate of five-axis machining centers is only 12% (Japanese companies reach 65%), resulting in complex surface processing still relying on manual finishing; the installation rate of online detection equipment (such as Renishaw probes) is less than 8%, and dimensional detection takes up 30% of the production cycle.

The problem of equipment heterogeneity: There are mixed brands of equipment in the workshop (FANUC/Siemens/Huazhong CNC coexist), the protocol interoperability rate is less than 40%; the proportion of old equipment exceeds 55% (service age > 10 years), and it is impossible to access the Industrial Internet platform.

- Fragmentation of industrial software applications

The CAE simulation software authenticity rate is less than 25%, the mold flow analysis error rate exceeds 35%, gate design errors lead to a 50% increase in modification costs, and the number of mold trials reaches 7 times (3 times at the international advanced level).

The success rate of connecting the MES system with equipment data is less than 45%, the coverage rate of visual management of production progress is only 30%, and the delivery delay rate exceeds 40%.

The PLM system design data reuse rate is less than 20%, the time consumption for repeated modeling of similar molds accounts for 60%, and the design cycle is extended by 50%.

- Data asset sedimentation dilemma

Data collection failure: The collection completeness of key process parameters (such as EDM pulse width/gap) is only 38%; the missing rate of equipment status data (spindle vibration/temperature) exceeds 60%.

Knowledge management gap: The mold failure case database is only 25% complete, and the trial and error cost for new engineers has increased by 3 times; 90% of the process parameter optimization experience is retained in the minds of old masters, and their resignation leads to a technology gap.

- Double gap in talent structure

Mismatch in skill dimensions: The proportion of engineers who can operate CAD/CAE/CAM simultaneously is less than 15%; there is a large gap in compound talents who understand mold technology and are familiar with Python data analysis.

Organizational inertia resistance: 70% of companies still use the “drawings + experience” decision-making model and reject data-driven management; management’s digital awareness lags behind, and 30% of companies use their IT budget to repeatedly purchase stand-alone software.

- Cost-benefit imbalance restricts investment

High transformation costs: The cost of transforming a single line in a smart factory exceeds 5 million yuan, and the payback period is >8 years; the training cost of five-axis programmers is 120,000 yuan per person, and the turnover rate exceeds 45%.

Short-term benefits are unclear: 80% of companies see a decrease in efficiency in the first year after digital investment (system running-in period), and only 5% of companies can quantify the cost savings brought by digitalization (such as a 3% decrease in material loss rate).

- Digitalization gap in the industrial chain

Upstream and downstream data breakpoints: The compatibility rate between the OEM CAD data and the mold factory CAM system is less than 50%; the material supplier’s physical property parameters are not embedded in the mold flow analysis software, resulting in a simulation deviation rate of more than 25%.

Lack of collaborative standards: There are 120 differences in mold data delivery standards among various OEMs (such as tolerance marking system); due to security concerns, the actual utilization rate of cloud platform data exchange is less than 8%.

- Misalignment between technology supply and demand

The solution is not suitable for the local environment: general industrial software (such as SAP) cannot adapt to the non-standard characteristics of the mold industry, and the customization cost exceeds 3 million yuan; 70% of companies reported that the existing digital system increased redundant workload by 30%.

Technological iteration is out of touch: the application rate of digital twin technology is less than 2%, and virtual debugging is limited to leading companies; the AI defect detection algorithm has an accuracy rate of only 65% on the surface of complex textured molds.

6. the talent gap crisis

The talent gap crisis in the injection mold industry is the result of the long-term effects of multiple factors, the root causes of which involve structural contradictions such as lagging education system, declining career attractiveness, and accelerated skill iteration. The main reasons are as follows.

- Misalignment between education supply and industry demand

Training in colleges and universities lags behind: the number of graduates in mold and die majors in undergraduate colleges and universities nationwide is less than 8,000 per year, which can only cover 1/4 of the industry’s needs; the curriculum system is still dominated by traditional machining, and the coverage rate of cutting-edge technology courses such as five-axis programming and mold flow analysis is less than 15%.

The vocational education system is dysfunctional: the update cycle of practical training equipment in vocational schools exceeds 8 years (for example, three-axis machine tools are still used for teaching), the proportion of “dual-qualified” teachers is less than 30%, and the time that front-line technical experts from enterprises participate in teaching is less than 50 hours/year.

- Distorted career development channels

Junior technicians (apprentices) earn 40,000 to 60,000 yuan per year, with a promotion cycle of 5 to 8 years and a turnover rate of 45%; mid-level engineers earn 80,000 to 120,000 yuan per year, with a promotion cycle of 3 to 5 years and a turnover rate of 30%. The pyramid structure has led to hopelessness of promotion for those born after 1990, with 60% changing careers within five years of entering the industry.

- The speed of skill iteration crushes the supply of manpower

The complexity of technology has increased sharply: modern mold engineers need to master more than 5 kinds of industrial software, 3 types of equipment operation, and 2 cross-border knowledge at the same time. The full skill training cycle has been extended from 3 years to 5 years.

The inheritance of experience has been interrupted: the average age of senior technicians is 52 years old, and 50% will retire in the next five years; the “master-apprentice” model has collapsed, with the number of apprentices a master has dropped from 5 to 1.5.

- The industry’s attractiveness continues to decline

Disadvantages of the working environment: workshop noise > 85 decibels and oily environment discourage job seekers born after 1990.

Social cognitive bias: 72% of parents are against their children working in the mold industry.

- Short-sighted corporate training mechanism

Insufficient investment in training: The industry’s per capita training funding is less than RMB 800 per year; 70% of companies have not established a skill certification system, and employees rely on self-exploration to grow.

Utilitarian employment strategies: 45% of companies adopt a “plug-and-play” recruitment strategy and refuse to train fresh graduates; the average annual training time for technical backbones is less than 24 hours.

- Regional flows exacerbate imbalances

Regional siphon effect: 80% of high-end talents are concentrated in the Yangtze River Delta/Pearl River Delta, while the talent recruitment rate of enterprises in the central and western regions is less than 40%; inland enterprises are forced to poach talents with 1.5 times the salary, pushing up employment costs

International talent competition: German mold companies have recruited Chinese technical backbones through the “Blue Card Program” with an annual salary premium of 50%; Southeast Asian companies have offered double the salary to poach Chinese five-axis programmers.

As a rapid prototyping factory, facing these six major difficulties in the industry, we feel deeply powerless. Apart from trying our best to survive, there is really nothing we can do.

So, do you think there are solutions to these six major difficulties of injection molds? If so, which one is the easiest to solve?